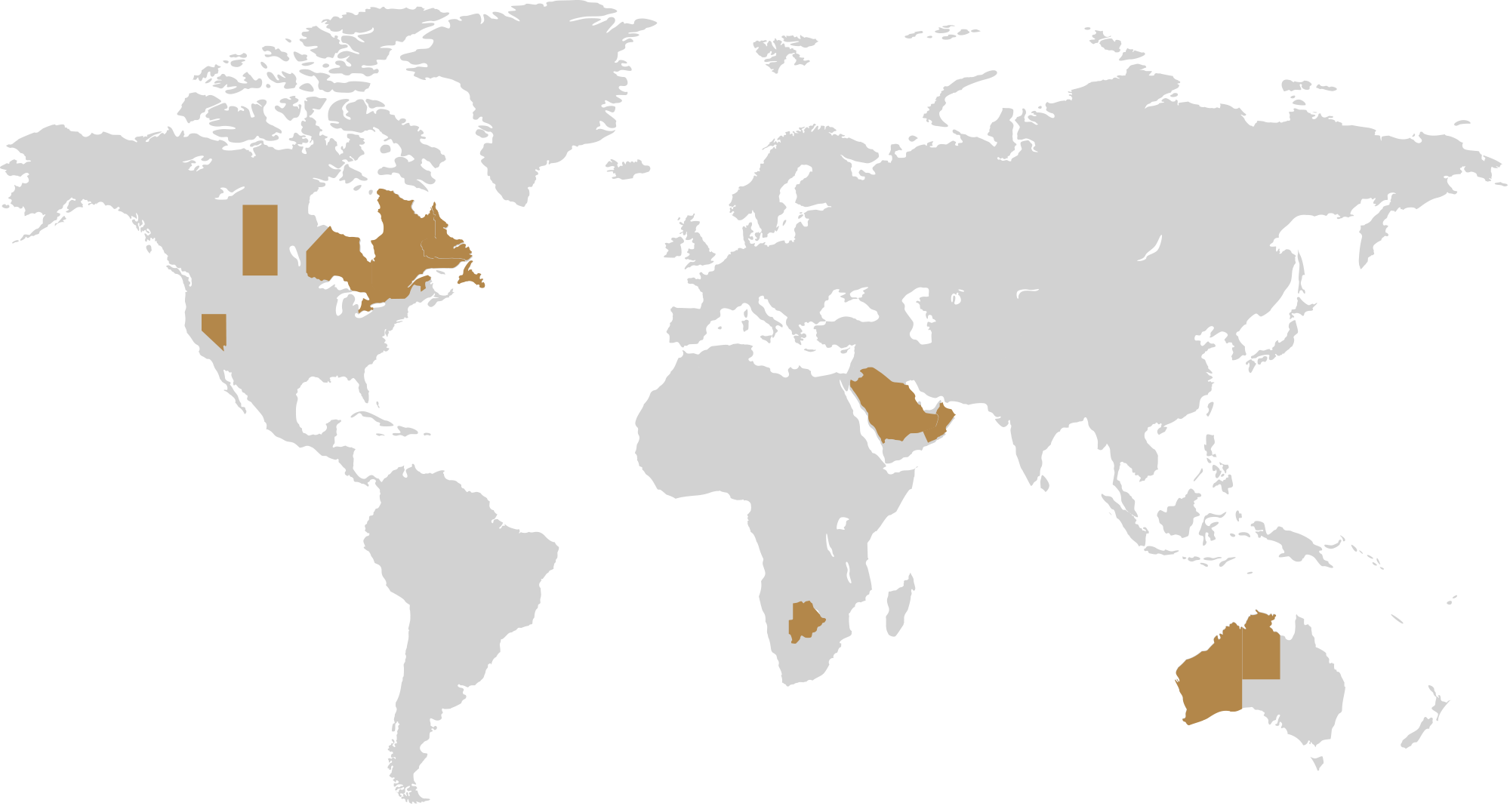

Power Metal develop early-stage resource opportunities. With a solid understanding of corporate finance, the Company can then match these opportunities with the right capital. Over time Power Metal will then crystallise these opportunities allowing shareholders to benefit.

Power Metal develop early-stage resource opportunities. With a solid understanding of corporate finance, the Company can then match these opportunities with the right capital. Over time Power Metal will then crystallise these opportunities allowing shareholders to benefit.